Operation Obliterate Debt

My Plan To Get Out Of Debt In 3 Years

No More Harvard Debt says:

Debt Pay-down Is a Marathon, not a Sprint … This is 26.2 miles up the side of an extremely steep mountain.

Obliterating my Student Loan debt has become my top priority. This is my battle plan.

I am embarking on the challenge of rapid debt repayment. The next few years will challenge my former relationship with money and my former lifestyle. I am doing this by choice. I am choosing to take the more difficult route, the route that will lead to financial freedom. I am choosing this because it is hard and things that are hard tend to reap the best rewards. Today I will lay my debts out on the table, acknowledge them, and form my plan.

The Back Story

After four years of college I have accumulated quite the portfolio of student loans. Unfortunately this is not a good portfolio, this portfolio pretty much represents my entire net worth (in a monetary sense) and it is a very large, negative number.

To pay for my first two years of college I took out substantial private loans through my bank, Wells Fargo. I needed the loans to cover my tuition expenses but I also used them to cover housing costs, textbooks, and food. I was also able to take out a few small Federal Loans that helped to cover a small portion of my annual university costs. However, I did not qualify for subsidized interest rates on my Federal Loans nor did I qualify for financial assistance from my university. So, Wells Fargo was there to pick up the slack and fund the rest of my education / college experience.

In 2008 the US financial markets crashed and lending from private banks dried up. I was only half way through my four years of education yet Wells Fargo informed me that I no longer qualified for a private student loan. I was stuck; I needed to graduate in order to get a job to pay off my debt that I needed to incur in order to get an education so that I would qualify for a job (follow that?).

My university told me that I did not qualify for need based aid, apparently my parents made too much money. My parents told me that they couldn’t afford the high cost of my private university education. For a few months the situation became desperate, I was on the verge of being forced to drop out of school. Eventually I was able to find a solution. My parents were willing to take out a parent loan to cover the cost of my education on the condition that I pay them pack. I jumped at the offer.

So I was able to fund my education. I borrowed the money, I went to school, I graduated, I got a job, and I started paying it all back.

The Numbers

That is essentially the process with which I assembled my student loan portfolio. I now have a good mix of liabilities from Wells Fargo, the United States Treasury, and of course the Parentals. I am now finally acknowledging these debts and facing them head on.

Here is what they look like:

Wells Fargo Debt ($729 payment):

- $36,000 @ 9.49%

- $34,500 @ 6.25%

The Feds ($174 payment):

- $5,000 @ 5.6%

- $3,300 @ 4.5%

- $2,000 @ 6.8%

- $1,300 @ 6.0%

- $1,200 @ 4.5%

- $1,300 @ 6.8%

- $500 @ 6.8%

Other Feds ($50 minimum):

- $3,400 @ 6.55%

Parentals (no payment):

- ~$20,000 @ 0%[1]

Total monthly payment: $953

I also have a few assets! Most notably I have a savings account with $6,500 sitting in it earning 0.14% each year. That is a real return of -1.56%. Not so good. I also have a 401(k) with $6,000 in it but that is money that I cannot touch. I will pretend like I do not even have it. Additionally, I always keep a $1,000 buffer in my checking account. So that is forgotten as well.

As you can see I have 11 different loans across four different lenders. I know, the overall balance is huge. Yes, there are things I could have done differently so that the balance would have been smaller. Though I must admit, I do not think it is that bad. I went to a pretty good university, I had a wonderful experience and I am now employed in a pretty great job. I am extremely lucky that things have worked out so well for me. Now all I need is a plan to obliterate this debt.

The Plan

The plan is quite simple really. I will focus my entire attention on wiping out my two private student loans which make up the bulk of my outstanding balance. I will focus my attention on my highest interest rate loan and work my way down from there.

So, my first goal is to tackle that high interest rate private loan which has a remaining outstanding balance of $36k at 9.5%. This interest rate is also variable which means it could go up in the future and greatly affect how much I will pay over the life of the loan. I will need to get serious about making extra principal payments on this loan. I estimate that it will take me 20 to 24 months to eradicate this debt.

Secondly, I will then focus my attention on the other private loan which has an outstanding balance of $34.5k at a 6.25% fixed interest rate. Once the first loan has been paid off I estimate that it will take me approximately 14 months to vacate this debt. Overall, my goal is to have the entire private loan debt paid off by the end of 2015. Only three years. This will accelerate my payoff date by 11 years and save me $35k in interest payments over the life of the loan. My extra payments against the principal of these loans will total $59,000. That is the amount of extra money I need to pay over the next 36 months to eradicate these two loans and be free from debt eleven years early.

This is the main reason that I want to focus on paying off these major debts first. If I am able to achieve my accelerated payoff schedule I will save $35,000 in interest payments over 14 years. $35,000! When I did the math my jaw hit the floor. I always knew that the longer the repayment period is the more you end up paying for the loan. Taking the time to actually add up what those interest payments amount to was all the face punching I needed to get my butt in gear. It is time to pay off some debt.

The below chart illustrates the power of extra payments against the principal of a loan (in this case the cumulative outstanding balance of both of my Wells Fargo loans). The red line shows the effect on the outstanding balance of making the regular scheduled payments for these loans over time. As you can see I will finish paying off these loans in 2026 and will have paid a total of $66,579 in interest. This sounds like a horrible plan to me. I think I will go a different route.

The green line shows you my plan for paying off my debt obligation. I had to estimate the future balance of these loans based on the extra payments I plan to make each month and how much those payments would go toward interest and principal. I would rate this plan as moderately aggressive, meaning this plan sets a high bar for what I hope to accomplish. Things I had to estimate include my annual tax return, my annual bonus, my monthly rent cost (I only know this for certain through Feb ’14), and my expected annual salary increase. These are variables that will have an effect on my ability to make extra payments on my debt. I also made some other assumptions that I talk about below.

Given that disclaimer you can see why I am choosing the green option over the red. I want to be a badass! If I am able to meet the payoff date I will have saved $35,000 in interest payments and be free from these debts eleven years early. Additionally, I will no longer have a $729 monthly payment to make. This frees up a lot of cash flow for other things. Primarily, more cash flow means a quicker march towards financial independence. Yes, this is the plan for me. Now I just need to budget for it.

The Budget

To reach my debt pay down goal I need to form a serious budget and stick to it. I have always had some form of a budget that spelled out my fixed costs, what I estimated my variable costs to be, and a section for savings. I never really stuck to it. I always pay my bills on time and I haven’t run a credit card balance since last year but there have never been any consequences for my overspending. I bring home a nice package of bacon that easily covers all of my fixed costs and leaves me with about $1,000 in discretionary spending each month. That is a huge sum of money but it is also very easy to blow on happy hours and weekend bar trips.

Even before I found NMHD and MMM I lived a fairly frugal lifestyle. Yes, I spent too much at the bars and yes my apartment doesn’t need to be so nice but I also don’t own a car, I walk to work, I cook for myself 90% of the time, and I rarely travel. My biggest luxury was probably Cable TV. That is why in my first year after college I was able to pay off a $3,000 credit card and put $6,500 in savings, even though I bought a new iPad.

I am not going to go into the details of my former spending habits today but I am going to talk about my new, stricter budget that will get me on the road to freedom. This is what I am planning:

Fixed Costs:

- Rent: $1,152

- Utilities: $52

- Electricity: $25 (average over year)

- Cell Phone / Internet: $40

- Private Loans: $729

- Feds Loans: $174

- Other Feds: $50

Variable Costs:

- Food: $150

- Other: $65

I think I can easily live by this budget. Besides my prior habit of cable TV a quick glance at Mint.com reveals that I had a few months in 2012 that were near this level of spending, and I wasn’t even trying! So if I can do this then I will free up some cash flow for radical debt payments.

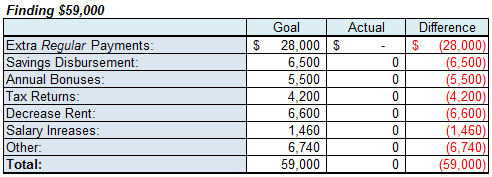

Extra Regular Debt Payments:

- Private Loan: $800

If you were paying attention above you will realize that an extra payment of $800 per month is not going to get me to a total of $59,000 in extra payments in three years. In fact $800 per month will only equate to $28,000 over the next 35 months. That leaves me with $31,000 that I have to find in order to reach my goal. That is no small feat.

My above budget is already stretched to the max so I must find another route to come up with even more extra payments.

Finding $31,000

I am about $31k short of reaching my three year pay-off goal. That equates to about 860 extra bucks a month. That is money I do not have so I must find it.

To begin I will wipe out my savings and dump it into my high interest private loan. Bam, that takes a $6,500 chunk out of that $31k. I am comfortable living with only a $1,000 buffer in my checking account. I am secure in my job and I don’t own things like vehicles or houses that may have large unexpected costs that could surprise me. Once that $6,500 is disbursed I will be $24,500 short.

Now I need to find $24,500. Between now and December 2015 I will have three bonus payments that I will wholly apply to the outstanding balance of my loans. However, I do not know what my bonus will be so it’s time for some educated guessing.

My last bonus payment was a little north of $1,500 after tax and other payroll deductions. My bonus was well above target due to my outstanding performance; let’s hope I can keep that up. I am going to be bold and say that I will be able to increase that by 10% each year over the next three years. That comes out to about $5,500. Hopefully they will be even bigger than that. That brings the delta to my goal to $19,000.

What do you know? I’m also going to get 3 tax returns over the next three years. I try to pay as little to the government as possible but with only one exemption and all of my deductions (most notably student loan interest) I will end up with a pretty large tax return. I’m expecting $1,400 this year. Let’s say that holds for the next three years giving me $4,200. Now I’m down to finding $14,800.

I’m currently stuck in a pretty expensive lease (even though it’s still below the median for where I live) for the next year. Once that lease is up I will have to move someplace less expensive. There are many options from moving into a studio, moving outside the city, to moving into a house with others. I’m not sure what I will decide on but I am going to go big and say I can reduce my rent costs by $300. At that point I will have 22 months left until my debt pay-down date which will free up $6,600 in cash flow to move towards my debt balance. Now my outstanding goal is $8,200.

Now this is where things get tricky, this is where the fun begins. I have pretty much exhausted all of the various extra income streams that I expect over the next three years. I am still short $8,200. I can see a few options but I am hesitant to pursue them.

I can cut my 401(k) contributions. This would give me an extra $250 a month, or $9,000 towards my debt pay down. That right there would be enough to meet my goal by December ’15. However, I am extremely reluctant to do this. I would miss out on three years of my employers match which amounts to an extra 4% of my salary. This is free money! I am not like the baby in the Capital One commercial; I will not forgo free money. [2]

I could get a second job. Let’s say I got a weekend gig waiting tables at a restaurant or making coffee at a Starbucks I could walk to. Let’s assume I take home $6.80/hr and work two shifts each weekend for 10 hours total. Let’s also assume it takes me a month to find this job. Another assumption is that I wouldn’t work 6 weekends out of each year. Based on these assumptions over three years I would make an extra $9,000. That would get me to my goal! Not bad!

The problem with this idea is that I often have 60 to 70 hour work weeks (including logging some time on the weekends) at my current job and while it’s not explicitly stated it is implied that I will not work a second job. I cannot see this working out without the performance at my current job suffering. That makes it a no-go.

One thing that hasn’t been discussed yet is salary increases and promotions. I do have an annual salary review and I am also well on my way to a promotion. However these things are not guaranteed nor can I guess what kind of financial impact they would have. But I’m going to go out on a limb anyways and set a goal that I get a salary bump of 5% for 2014 and another 5% for 2015. Based on those numbers I would be able to increase my regular extra payments by 5% for a total of $1,460 in extra payments in ’14 and ’15. That gets me down to $6,740 that I still need to make-up in three years.

This is about everything I can think of. I will have to put more thought into finding an extra $6,740. Maybe somebody will happen by with a great idea that I haven’t thought of yet (comment below!), maybe I will win the lottery (that I never play), maybe I will get larger bonuses and a big promotion (one can hope), or maybe I will do 1,348 jobs on Fiverr (that sounds awful). For now I am just going to leave this as TBD and chew on it a little more. [UPDATED!]

Disclaimer

Wow, I made quite a few assumptions in that previous section; after all it is hard to plan the next 6 months let alone the next 3 years. Please, allow me to explain. Some of these assumptions are beyond my control (tax return) but others I can reasonably effect. I am setting these assumptions as goals. For example: my goal is to have an after tax annual bonus totaling $5,500 over the next three years. My bonus is directly correlated with my work performance, I directly control how I perform at work. I will track these goals through the below spreadsheet and update you periodically. This will also allow me to see areas that I am slacking in and areas where I have exceeded expectations.

As all things in life, except death and taxes, nothing is guaranteed. I could lose my job tomorrow (highly unlikely but still a chance), I could have a major medical expense in the next three years, I might get transferred to a more expensive city, who knows? I could spend hours and hours speculating on things that might keep me from my goal. There is nothing to be gained by doing this, so there is no point in doing it. I will take what comes my way and do my best to roll with the punches.

The Starting Line

The task seems so daunting right now. Just the extra payments on my loans are more than my gross income last year. Trying to do this in three years seems so crazy and impossible. Even then, I will still have approximately $12,000 in federal loans and will owe my parents some $20k. I will not be debt free. However, those outstanding balances will seem small compared to the giant weight that will be lifted off of my shoulders when I no longer owe Wells Fargo a single dime. Also, I will be in a great position to quickly pay those off.

My driving force is the multitude of possibilities that await me once I am debt free. The opportunity cost of $35,000 in interest payments is astoundingly high. I can travel the world, I can put a down payment on a house, I can invest for retirement, I can donate. Most of all I will be well on my way towards financial independence.

Until that time I will use this period of debt repayment as an exercise in life improvement. I will live more frugally. I will live a happier and healthier life. I will chronicle my marathon through this blog. My journey to the freedom from debt is about more than just money and wealth; it is about me finding the way to a more fulfilled life. My 26.2 miles starts now and I can’t wait to get going.

Notes

1. My parents are paying interest on their loan but won’t be charging me extra interest, that is why I recorded this as 0%.

2. No More Harvard Debt cancelled his 401(k) contributions during his debt repayment. In all he missed seven months of his employer match, I would miss 36. That is too much money for me to give up. No thanks.

Hi, I just found your blog today on twitter through MMM’s tweet. I really like what I’ve read so far, it looks like you know what you’re doing. I agree w/ not ceasing the 401K; 36 months is too long to forgo free money.

As far as extra income goes, maybe you can keep an eye on the gigs section on CL. Also, what are you thoughts on putting up some ads on this blog?

Goodluck!

Sweta, thanks for the feedback. I have never checked out the gigs section of CL, I will definitely do that. I also don’t want to put ads on the blog because I want it to be a tool for me to set goals and track progress instead of it being a job where I am trying to make money.

Hey, I followed you here from MMM’s message boards. You have a great story and a good writing style.

On the part-time job thing: I hear you. I have the kind of skills that would easily allow me to pick up extra work nights and weekends. But I have the kind of job that demands the hours go to them.

Is there some other skill you have where you could bring in income on your own schedule? Babysitting, face-painting at parties, fixing computers, setting up home TV/entertainment systems, home improvement, mowing lawns…? We don’t have any income streams like that, but we tend to “barter” our skills with friends, which ends up saving money…helping others with home improvement, swapping baby sitting.

At one point, pre-kid, I was seen making a blanket for a niece and two people paid me to make blankets for them (I’m female.) I have a blogger “friend” who makes her boss and sister-in-law’s lunches each week and makes soup for the whole company on Friday and charges 2 bucks.

Thanks for the feedback Marcia. I am starting to think that the best way to increase my income is through my job. I work in an industry where my pay is tied fairly closely to how I perform. I am evaluating what my options are to really step things up this year. Also, I really like your blog. I grew up as a huge fan of Legos! Maybe I should have been an engineer 🙂

Pingback: Focusing On My Goal « Student Loan RAGE

9% interest on a student loan should be criminal.

Your budget looks solid. It doesn’t look like there’s much to cut, though I’m sure you’ll surprise yourself with the extra money you find just by being diligent.

I did want to talk about your numbers though. You say you’ve got $31k to make up over the 3 years, but by my count it’s closer to $28k. As you pay down your loans aggressively, each regular payment you make has more going to principal than would otherwise be the case. Another way to think about it: as your outstanding loans dwindle, less interest is accruing so more of your regularly scheduled payments go toward principal. I could be wrong (though I hope I’m not), but to make sure, how much of the $729 is going toward the 9.49% loan, and how much toward the 6.25% loan?

Keep up the good work 😀

Yes, I did a little bit better with my calculations in the Focusing on my Goal post (https://studentloanrage.wordpress.com/2013/01/28/focusing-on-my-goal/). About $403 goes to the high interest rate loan each month and $326 goes to the other one. I’ve been using an amortization table and inputting my planned extra payments in excel to try and estimate what my future balance will be and that takes into account the lower balances to calculate interest on. I know 9.49% is absolutely insane! this was the loan I got in ’08 in the middle of the financial crisis. I am looking into options to see if I can consolidate the two private loans together and get a lower rate (the weighted average interest rate is around 7.5% so I save money if I can consolidate to a lower rate than that). Hopefully that will work out. Other than that I just need to keep on making extra payments! Thanks for your feedback!

I read your “Focusing on my Goal” post today and I was glad to see you already updated your calculations. You’ve been very thorough with your numbers! I’m confident you’ll make great progress and, if I were a betting man, I’d say you’ll reach your goal ahead of schedule.

Pingback: Hacking My 401(k) « Student Loan RAGE