Focusing On My Goal

The Hard Numbers on How to Punch-Out $70k in Debt

Early Retirement Extreme says:

This is what being heavily in debt must feel like. Paying and paying and never really getting anywhere. Fortunately, there is a way out: An extreme increase in payments.

Last time I talked about my outrageous goal of taking out my Wells Fargo student debt in just three years! I went into some detail about how much I owe, my new and improved budget, and the steps I need to take in order to funnel as much money as possible into my goal.

Today I am going to focus even more on the numbers. Specifically I am going to break down my Wells Fargo loans and really evaluate the steps to obliterating these debts in three years. The simple math says I need to make an extreme increase in payments. Let’s begin.

Outstanding Debt

From here on out I am only going to be focusing on my Wells Fargo debt. I will worry about my federal loans once I am free from my private student loans.

My total Wells Fargo debt stands at $70,500. This is made up by two loans, one with a 6.25% fixed interest rate and one with a 9.49% variable interest rate. I made a total of $8,700 dollars in loan payments in 2012, that amount almost entirely went towards paying off interest. The outstanding balances on the two loans are:

- $36,000 @ 9.49%

- $34,500 @ 6.25%

The payment that is applied to loan 1 each month amounts to $403 and $326 goes towards the second loan. I will continue to make the regular payments on both of these loans. I am also going to be making large extra payments starting with the principle of the high interest loan first and moving on to the second loan. To begin, this month I will distribute my entire savings into that loan ($6,500).

The Extra Payments

This is my goal for extra payments in the coming months and years:

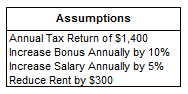

I make some assumptions here that will effect how much in extra payments I can make.

There it is in black and white. A simple tally that of what I need to do each month over the next thirty six months. Let’s hope those assumptions hold true and I can make a good start on my way to financial freedom.

The Plan

So, my plan is to push all of these extra payments into the large interest rate loan and then into the remaining Wells Fargo loan once the first one is paid off. Note, once the first Wells Fargo loan is paid off that will free up $400 in cash flow. I will automatically pump that cash flow into the second loan and just treat it as a regular full payment. This is the important data point that I missed in my last post.

In my last post I was trying to calculate the amount in extra payments I needed over the next 36 months to get to a total Wells Fargo outstanding balance of zero. As I have come to realize, I made some errors in this calculation. I was utilizing an amortization table and plugging in random numbers that would get me to a zero balance on December 31, 2015 (mostly trying different scenarios in goal seek). I did not take into account interest! By paying off one loan at a time I will be freeing up cash flow from regular payments to be moved over to the other loan.

I went back to the amortization tables and plugged in my plan for extra payments Excel calculates that I will have the high interest loan (Wells Fargo 1) loan payed off in September, 2014. 21 months from now! At that point I took the remaining additional payments plus the regular payments from loan one and plugged those into the amortization table for loan two. Based on those calculations I will have a remaining balance of about $600 in December, 2015.

Whoa! that means that I am pretty close to achieving my debt pay down goal in 36 months! I have doubled checked the numbers and they seem to hold true. As long as I am able to meet my above payment goals then I will be just about Wells Fargo debt free by 2016. This is already a great improvement on my last post where I had calculated a remaining balance of $6,740 in December, 2015. Things are looking good!

Focusing on 2013

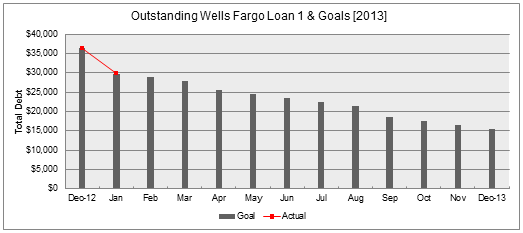

I am going to take this process in small steps by focusing on one year at a time. In 2013 all of my extra payments will be going towards the first Wells Fargo student loan. By the end of 2013 my goal is to have an outstanding balance of $15,400 on that loan. A drop of $21,000 from today’s balance of $36,400.

This chart illustrates my goal and plots my actual progress (estimated for January).

My extra payments in 2013 will total $18,520 made up of my savings disbursement, extra monthly payments, my tax return, and a bonus in September. I feel good about these numbers. I think I can achieve this goal. Overall I will be increasing my total student loan payments (including regular payments) over the year by 162%! Not to shabby.

I am currently building a budget that will be able to track all of these numbers and give me my progress on a month by month basis. I will update the above chart each month and post about how I am doing. Hopefully I will be right on schedule with debt payments over the next twelve months and that my payments are extreme enough to get me on the path to freedom from debt!

Photo by Katie Dalton

Pingback: Operation Obliterate Debt « Student Loan RAGE

Mr. Derp,

I think you are selling yourself short. You have your extra payment after a 5% raise going from $800 to $840, but that assumes your spending goes up 5% as well. If your monthly take home pay is something like $3000, 5% of THAT is $150/month. If you take all of your raise and put it towards your debt, your extra payment after October will be closer to $950. (Make sure you substitute inferior goods to offset inflation, though!)

That is a very good point Mr. Pants. That is something I have not considered yet. My goal, ultimately, is to put more than the $800 budget each month towards the student loans. Whatever is left over should go to the loans, so this is something I will have to tweak. Thanks for the input.

Pingback: Badass Budgeting « Student Loan RAGE

Pingback: Hacking My 401(k) « Student Loan RAGE

Pingback: Why Are Young People Buying Less Stuff? | Student Loan RAGE